What the 2025 Tax Legislation Means for You

/What the 2025 Tax Legislation Means for You:

Highlights from the “One Big Beautiful Bill Act”

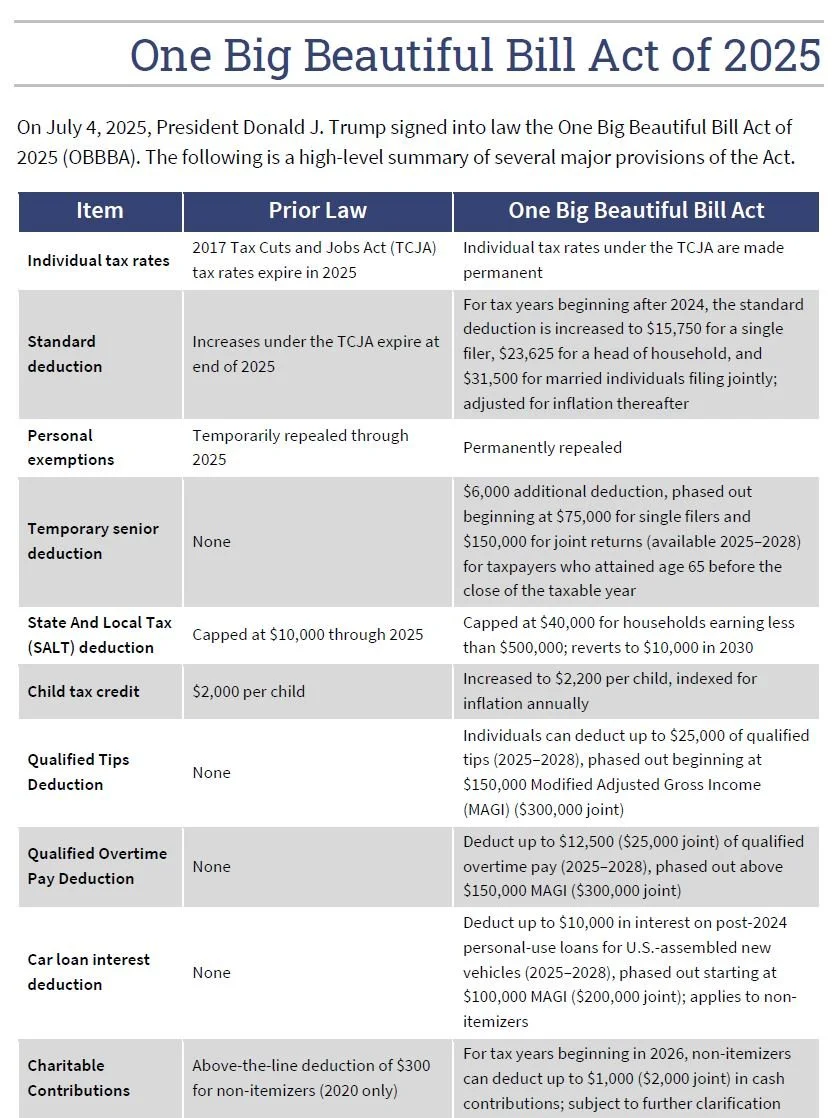

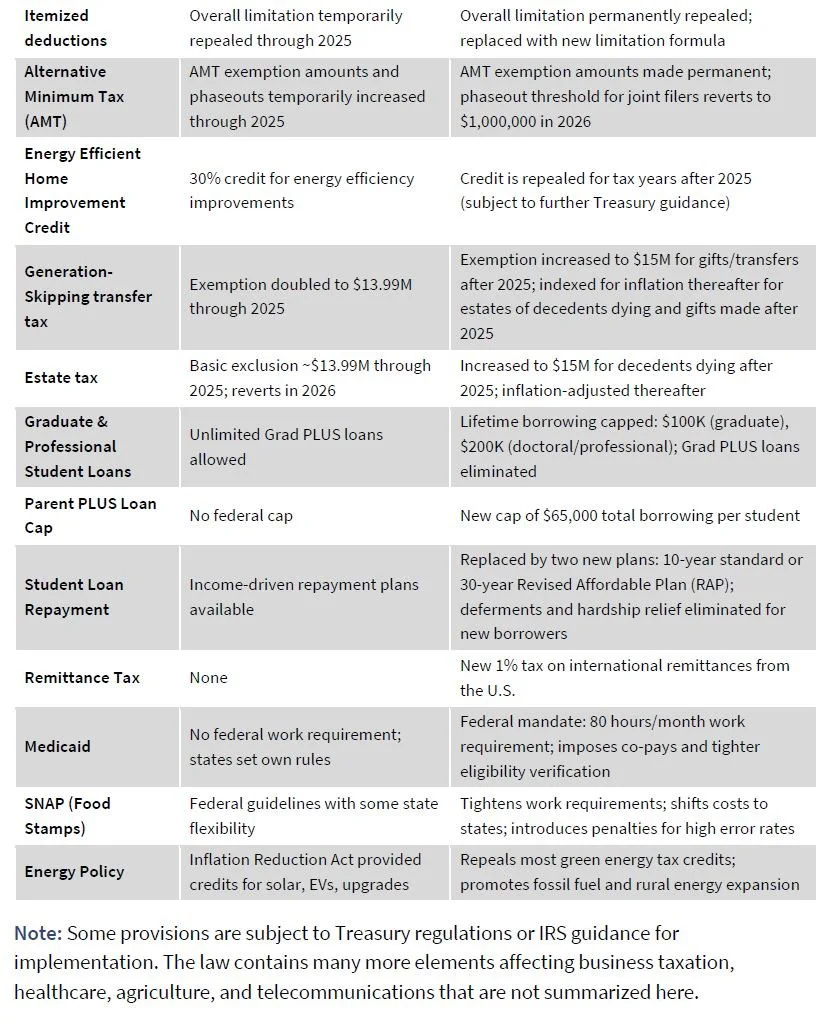

As we enter the second half of the year, one of the most consequential developments for individuals and businesses is the passage of the much-anticipated 2025 tax legislation—formally referred to as the Tax Relief for American Families and Workers Act, but popularly dubbed “One Big Beautiful Bill Act” (OBBBA).

Designed to extend and preserve many of the favorable provisions of the 2017 Tax Cuts & Jobs Act (TCJA), this new legislation provides clarity around tax planning for high earners and business owners, while introducing a handful of noteworthy new benefits. Here’s what you need to know:

1. Individual Income Tax Rates Remain Favorable

The bill “permanently” extends the individual tax brackets established under the TCJA, avoiding a scheduled reversion to higher pre-2017 rates. This means the 10%,12%, 22%, 24%, 32%, 35%, and 37% marginal tax brackets will continue—an important win for high-income individuals and families looking for long-term predictability. Notably the 10% and 12% bracket levels also received inflationary adjustments.

2. SALT Deduction Cap Expansion (with a Catch)

The cap on State and Local Tax (SALT) deductions increases from $10,000 to $40,000 for married couples filing jointly. However, this benefit starts to phase out for households with Modified Adjusted Gross Income (MAGI) between $500,000 and $600,000. This creates a planning opportunity for those taxpayers below the phaseout range—but may offer little relief for higher-income earners (with MAGI greater than $500,000). The marginal federal tax rate between $500,000 and $600,000 of MAGI can be as high as 45% taking into consideration the phaseout of the SALT deduction from $40,000 back to $10,000.

3. Standard Deduction and Itemized Limitations

The higher standard deduction established under the TCJA remains intact. The Pease limitation on itemized deductions is eliminated but replaced with a new limitation. Specifically, the effective itemized deduction benefit drops from 37% to 35% for those in the highest federal income tax bracket.

4. Estate Tax Exemption Rises

The estate tax exemption will increase to $15 million per individual in 2026 (from roughly $13.99 million in 2025), adjusted annually for inflation thereafter. This increase provides a larger window for legacy planning and tax-efficient wealth transfer strategies, especially for those with complex estates. The OBBBA legislation did not make any material changes to basis step-up, family entity planning, or grantor trust regulations.

5. New Individual Provisions to Watch

Four new tax breaks have been introduced:

Qualified Tips Deduction: Often referred to as the No Tax on Tips provision, this legislation doesn’t technically eliminate all tax on tips but provides a deduction on tip income received. The provision allows a taxpayer to deduct up to $25,000 of qualified tips from income for years 2025 to 2028. The deduction starts to phase out for Single Taxpayers with $150,000 of MAGI or Married Filing Joint Taxpayers with $300,000 of MAGI.

Qualified Overtime Pay Deduction: Similarly, there is a deduction for Qualified Overtime Pay, which has been referred to as No Tax on Overtime. The deduction is $12,500 for Single Taxpayers and $25,000 for Joint Taxpayers. The phaseouts are similar to the Tip provision. Note only the overtime portion of pay is excluded, not the regularly hourly rate. For example, if regular pay is $30.00 per hour and overtime pay is $45.00 per hour, ONLY the additional $15.00 per hour is deductible as “overtime pay,” subject to the aforementioned phaseouts.

Enhanced Temporary Senior Deduction: The Enhanced Senior deduction, touted as No Tax on Social Security, is a deduction up to $6,000 for Single Taxpayers and $12,000 for Joint Filers. The deduction starts to phase out for Single Taxpayers with MAGI of $75,000 and Joint Filers with $150,000 of MAGI. Projections from the legislation suggest roughly 88% of Taxpayers will now not incur tax on their Social Security (up from approximately 65%), but Social Security can still create a tax liability for high income individuals.

“Above the Line” Charitable Deduction: Starting in 2026, a new provision in OBBBA allows non-itemizers to deduct up to $1,000 ($2,000 for married couples filing jointly) for cash contributions made to public charities (does NOT apply to donations to Donor Advised Funds). This provision is similar to temporary deductions offered during the Covid-19 pandemic, which saw significant participation.

While some of these provisions are unlikely to benefit high-net-worth families directly, they could be meaningful for employees or children entering the workforce.

Additionally, interest paid on loans used to purchase domestically-produced vehicles may now be deductible—an incentive aimed at boosting U.S. manufacturing.

6. Business Owner Provisions Offer Significant Opportunities

This bill continues to provide robust support for entrepreneurs, medical practice owners, and closely held businesses:

199A Deduction Extended: The 20% pass-through income deduction for qualified business income (QBI) remains in place, continuing to provide substantial tax savings for those individual business owners who are eligible.

100% Bonus Depreciation Restored: Businesses can once again claim 100% bonus depreciation on qualifying property. Before OBBBA, bonus depreciation was at 40%.

Section 179 Expensing Increased: The limits on 179 Expensing (both the deduction and qualifying property place in service) have both increased.

Improved QSBS Treatment: Enhanced tax treatment of Qualified Small Business Stock (QSBS) makes equity-based planning more attractive and entity-based planning more important. Depending on your long-term goals with a business, whether a business is a pass-through entity or a corporate structure could have significantly different tax results.

What This Means for You

This legislation offers continuity in many areas while providing new opportunities for proactive tax planning. For individuals with significant income or estate planning needs, the preservation of TCJA rates and the expanded estate exemption could be especially impactful.

For business owners, the extended deductions and accelerated depreciation rules can materially improve after-tax profits and support reinvestment.

Next Steps

At Gilbert & Cook, we view tax planning as a key component of your broader wealth strategy. With the 2025 legislative changes now in place, we encourage a mid-year review to assess how these updates align with your personal and business goals.

Whether you're evaluating gifting strategies, planning a business exit, or simply looking to optimize your income and deductions—our team is here to provide clarity and confidence in every decision.

Let’s talk about how these new provisions may impact your plan—and how to position yourself to live a life of abundance.

Disclosure: The material presented has been gathered from sources believed to be reliable, however Adviser cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Gilbert & Cook does not provide tax or legal or accounting advice, and nothing contained in these materials should be taken as such. Gilbert & Cook is a Registered Investment Adviser. SEC Registration does not constitute an endorsement of Gilbert & Cook by the SEC nor does it indicate that Gilbert & Cook has attained a particular level of skill or ability